Get ready to buy

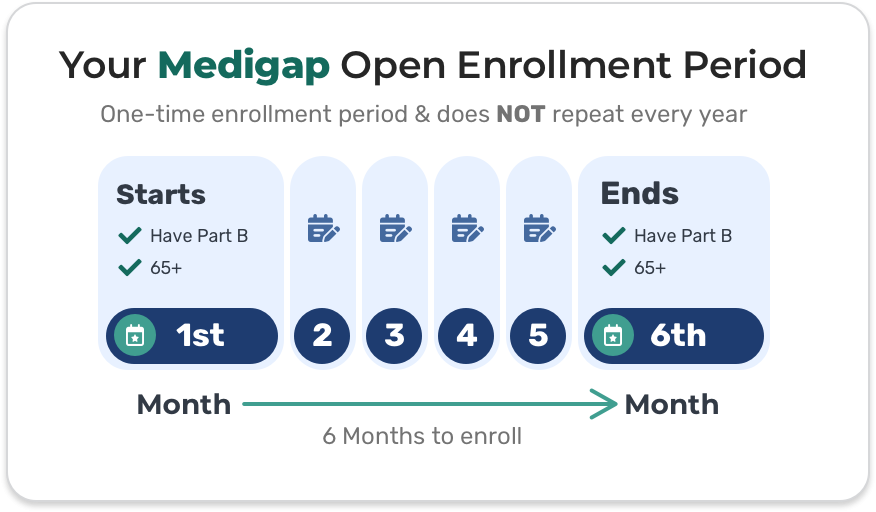

Your Medigap Open Enrollment Period

Under federal law, you get a 6 month Medigap Open Enrollment Period. It starts the first month you have Medicare Part B and you’re 65 or older. During this time, you can:

- Enroll in any Medigap policy. An insurance company can’t refuse to sell you any medical policy it offers. They also can’t use medical underwriting to decide whether to accept your application or deny you coverage due to pre-existing health problems.

- Generally get better prices and more choices among policies. Insurance companies can’t charge you more because of pre-existing health problems.

- Have your coverage start right away. An insurance company can’t make you wait, except for coverage related to a pre-existing condition.

After this period, you may not be able to buy a Medigap policy, or it may cost more. Your Medigap Open Enrollment Period is a one-time enrollment period. It doesn’t repeat every year, like the Medicare Open Enrollment Period.

Generally, your Medigap policy will begin the first of the month after you apply, unless you ask for a different effective date.

What if I miss my Medigap Open Enrollment Period?

Outside of your Medigap Open Enrollment Period:

- You may have to pay more for a policy.

- Fewer policy options may be available to you.

- The insurance company is allowed to deny you a policy if you don’t meet their medical underwriting requirements.

There are certain situations where you may be able to buy a Medigap policy outside of your Medigap Open Enrollment Period. Situations where an insurance company can’t deny you a Medigap policy are called “guaranteed issue rights” or “Medigap protections.” What are guaranteed issue rights?

What if I have Medicare because of a disability or End-Stage Renal Disease (ESRD)?

If you’re under 65 and have Medicare because of a disability or ESRD, you might not be able to buy a Medigap policy until you turn 65. Federal law generally doesn’t require insurance companies to sell Medigap policies to people under 65. However, in some states insurance companies do offer Medigap policies to people under 65. Check with your State Insurance Department about what rights you might have under state law. Which states offer Medigap policies to people under 65?

What do you want to do?

Find out when to buy

Answer a few questions to find out when you can buy a Medigap policy.

Learn how to buy

Follow these steps when you're ready to buy a policy.

Change your policy

Find out if you have a right under federal law to switch or drop Medigap policies.